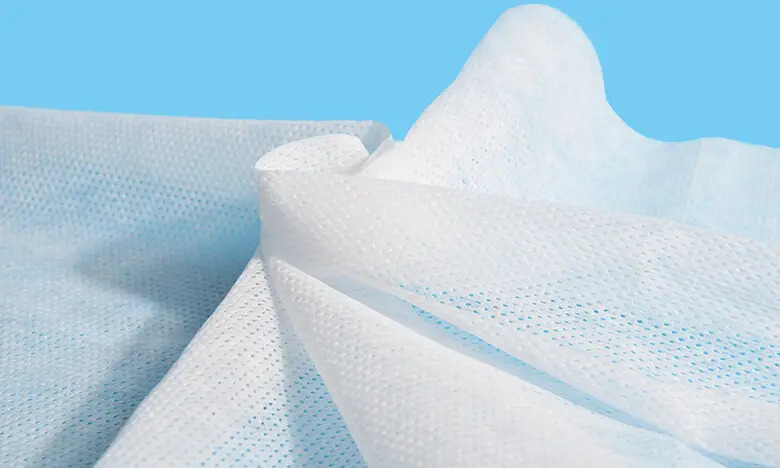

In recent months, as a consequence of the coronavirus spreading around the world, we have seen a surge in demand for nonwoven fabrics all over the world.

Overall global consumption in 2021 was 12.3 million tons, valued at $51.86 billion, indicating a market that had performed very well in the previous two years, according to the International Energy Agency. Even though demand for wipes, medical nonwovens, and meltblown facemask substrates has increased as a result of the pandemic's peak in 2020, demand has decreased in many industrial locations as a result of plant shutdowns during that time period.

By 2022, the overall volume of nonwovens will have increased to 13.4 million tons, with a market value of $56.4 billion at constant prices. The insights learnt from the Covid-19 pandemic will be used to guide future growth decisions. Producing nonwovens for medical and higher-grade personal protective equipment (PPE) will see a rise in demand in the next years as manufacturing capacity is reallocated to meet the strategic goal of avoiding recurrent outbreaks. You can click nonwoven machinery to find some information about machinery producing nonwoven fabrics.

The Covid-19 Pandemic Has Had An Impact On The Nonwovens Market.

The expertise gained at Covid-19 has altered the nonwovens market climate. Increases in raw material and transportation costs will continue to be top considerations, but meltblown will be oversupplied in the longer term as the present demand for protective facemasks diminishes in the longer term.

The need for lyocell, rayon, and other non-polymer fibres will increase in the next generation of nonwovens, as the industry strives to create more sustainable and biodegradable nonwoven products. The production of more sustainable substrates, such as those composed of cellulose or biopolymers, is being pushed harder than ever before in various nonwoven industries. Brand owners' interests in a range of consumer categories are aligned with this, as is the company's response to legislation such as the EU's Single-Use Plastics Directive and new wipe flushability criteria.

Smithers Research monitors the market outlook for four key nonwovens processes – airlaid, drylaid, spunlaid, and wetlaid – across 19 durable and disposable end-use applications in order to forecast future growth. According to the research, spunlaid nonwoven web forming is the most widely used nonwoven web forming process, accounting for 49.6 percent of all nonwovens used in 2022. Despite the fact that spunlaid is primarily dependent on polymer resources and therefore faces sustainability concerns, the company plans to continue to grow its market share. The rising demand for hygiene goods in developing markets, notably Asia, will result in it having a 55.2 percent volume market share by 2027, according to IDC.

The demand for both wetlaid and airlaid nonwoven substrates will be high over this period, while there may be a capacity shortage before 2025 if no new airlaid lines are built in the near future.

While drylaid demand will continue to grow, it will grow at a slower rate than the whole market. Wetlaid will have several unique market opportunities between 2022 and 2027, including increasing demand for double re-crepe (DRC) wipes and specialised wetlaids as battery separators for the growing electric vehicle category.

More emphasis will be placed on smarter supply chains as the nonwoven business evolves, with enhanced visibility, communication, and inventory management all contributing to increased efficiency.

Even after the COVID-19 outbreak has passed, global investment in the hygiene, medical, and wiping industries will continue to grow in response to the changing environment. Because of technological advances, the capacity for spunbond, meltblown, spunlace, and airlaid fabrics should continue to grow.

Not only that, but as procurement patterns shift and corporations look for more locally sourced fibers and chemicals, raw materials will confront new opportunities and challenges.

Besides the expansion of industrial capacity, there is an increasing emphasis on near-sourcing, which is the process of establishing more regionally focused supply chains. This is predicted to have a considerable influence on the nonwovens manufacturing industry. If you have interest in non woven machine, you can contact us immediately.