China's textile and apparel sector has emerged as a global powerhouse, consistently exceeding the $300 billion export mark for three consecutive years. This remarkable achievement underscores the resilience and strength of China's textile manufacturing industry. A key driver of this success is the industry's ability to harness raw materials such as cotton, fibers, and wool, transforming them into high-quality clothing that meets stringent standards and aligns with evolving consumer preferences. At the heart of this transformation is advanced textile machinery, which has played a pivotal role in propelling China's textile and apparel exports to new heights.

In the year 2022, China's textile and apparel exports soared to a staggering $340.95 billion, marking an impressive year-on-year increase of 2.5%. This milestone also signifies the third consecutive year of surpassing the $300 billion threshold in exports. These remarkable figures are backed by data from the China National Textile and Apparel Council, which reports a thriving B2B e-commerce sector within the textile and apparel industry, with a transaction volume of approximately RMB 6 trillion. Furthermore, online retail sales of clothing and home textiles have exceeded RMB 2 trillion, demonstrating sustained growth trends in these segments.

The continued strength and competitiveness of the textile industry can be attributed to the increasing integration of information technology and industrialization, alongside ongoing advancements in digital capabilities. As of December 2022, the comprehensive development index for the integration of information technology and industrialization in the textile industry reached 57.1, while the digitization rate of production equipment stood at 55.6%. Additionally, the networking rate of digital production equipment was 49%, with a readiness for intelligent manufacturing at 14.6%.

In 2022, fixed asset investments in China's textile, chemical fiber, and apparel sectors surged by 4.7%, 21.4%, and 25.3%, respectively, compared to the previous year. These statistics underline the robustness and competitiveness of the textile industry's supply and value chains. Notably, as China's textile and garment sector increasingly embraces e-commerce domestically, more enterprises and brands are expanding their horizons through cross-border e-commerce, opening doors to larger markets and untapped opportunities. While the United States, European Union, ASEAN, and Japan continue to be primary markets for China's garment exports, the potential for further expansion into other international markets is vast.

The Future Potential: Exploring New Frontiers

Recent years have witnessed the rapid expansion of the African e-commerce market, presenting a new frontier for cross-border e-commerce. Statistics from StockApps.com reveal that the African e-commerce market generated $28 billion in revenue in 2021 and is projected to reach $33.3 billion in 2022. By 2024, this market may surge to $42.3 billion, representing a remarkable 500% increase from the $7.7 billion recorded in 2017. Although the African clothing market is in the midst of transitioning from traditional trade to digital commerce, it lacks significant local brands. Chinese clothing manufacturers can leverage cross-border e-commerce channels to tap into this burgeoning market, offering local consumers a wider array of products.

The Latin American market also holds immense potential, with a significant demographic dividend and a high proportion of online shoppers. Despite this, the region's consumer market remains underdeveloped, presenting limited brand options and narrow price ranges for buyers. Chinese clothing brands equipped with competitive pricing and robust customer service capabilities have an opportunity to establish a significant presence in the Latin American market.

Challenges on the Horizon

Despite the promising opportunities, the garment industry faces a set of challenges when it comes to exporting. Fragmented orders, rising transportation costs, escalating labor costs domestically, an inventory backlog in overseas warehousing, and intensifying trade tensions are all hurdles that garment enterprises must navigate in the realm of cross-border logistics.

In conclusion, China's textile and apparel industry have showcased remarkable resilience and growth, backed by advanced technology and robust value chains. While there are challenges to overcome, the industry's potential for expansion into new global markets, particularly in Africa and Latin America, remains promising. Leveraging cross-border e-commerce, Chinese clothing brands can position themselves as key players in these emerging markets, offering consumers a diverse range of quality products while overcoming logistical obstacles to secure a prosperous future.

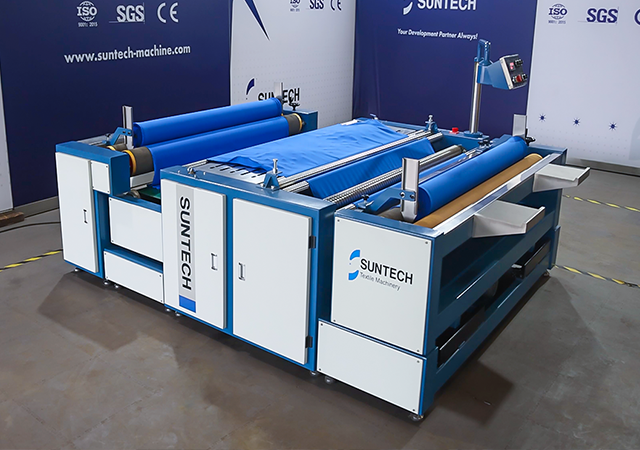

SUNTECH Textile Machinery has the range of products encompasses almost all fabric types, including but not limited to beam truck, fabric cutting machine, motorized beam trolley, beam storage, and fabric relaxing machine. SUNTECH Textile Machinery continues to lead the textile industry with its innovative approach and extensive experience. We welcomes quotes and cooperation opportunities with open arms.