Manufacturing sentiment is as bad as in 2009, orders have not yet recovered

From 2020 to 2021, most countries around the world will be hit by the covid-19 epidemic, and most industries, especially labor-intensive industries such as manufacturing and textiles, will be more severely affected by the epidemic.

The business confidence survey conducted by the European Commission showed that the degree of deterioration was similar to that in 2009 (Figure 1). Although the trough of manufacturers' activities has passed, data from June 2020 shows that European companies' orders have not yet seen a significant recovery. In terms of inventory levels, business sentiment deteriorated to a lesser extent and showed signs of mild improvement. Compared with their French and Italian counterparts, German manufacturers are generally more pessimistic in all market segments and order and inventory levels.(try suntech Loom)

Figure 1: Business Confidence Survey-European Union (Balanced)

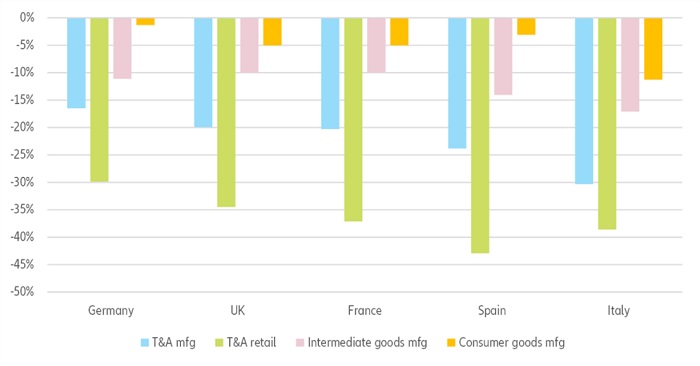

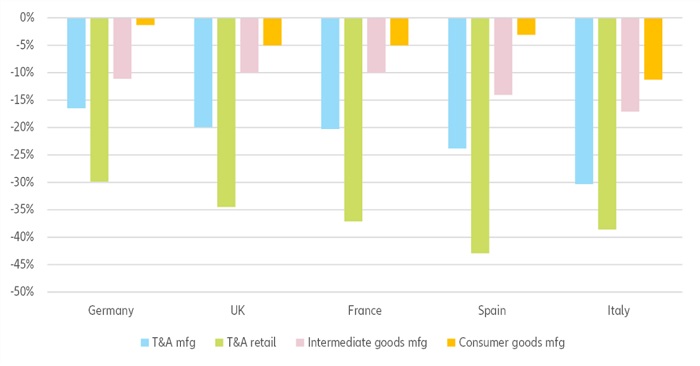

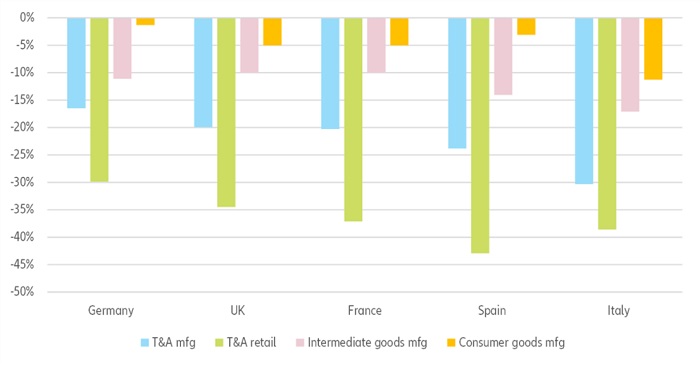

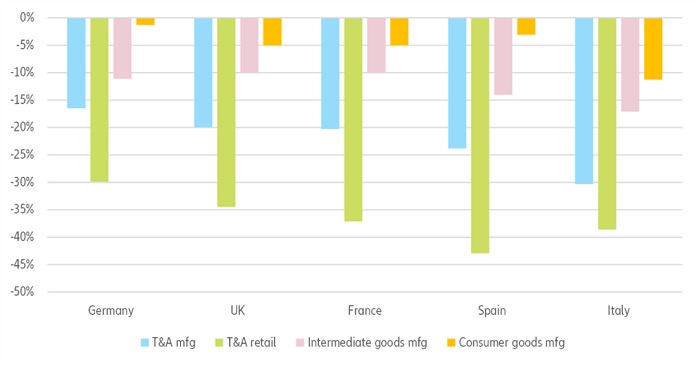

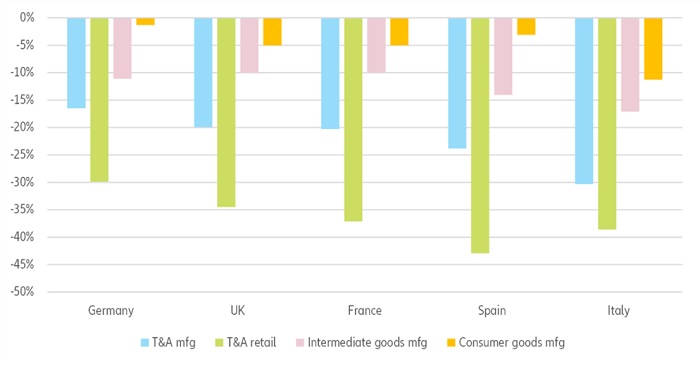

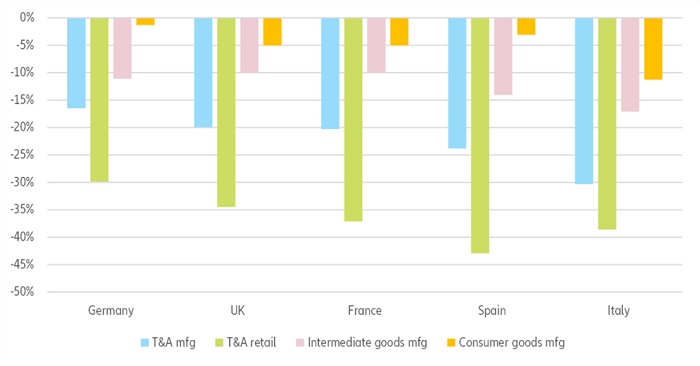

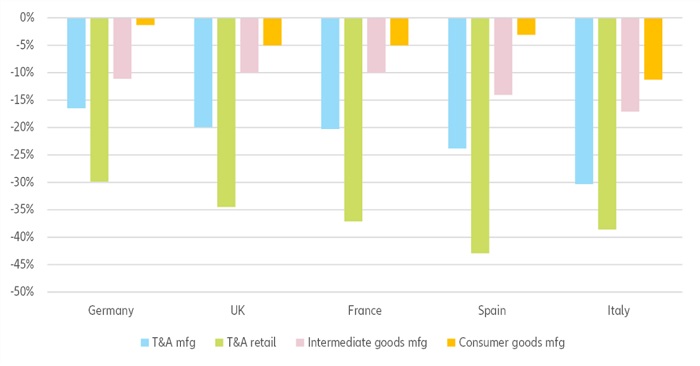

Comparing the business sentiment between the T&A industry and other manufacturing industries, we again found that in terms of orders and inventory, T&A is more pessimistic than the broader manufacturing industry. Just like in 2009, the industry’s recovery looks set to lag behind other economies (Figure 2).

Figure 2: Business Confidence Survey-EU, June data (balance)

Between 2008 and 2019, the textile and apparel industry has reduced 600,000 jobs and 22,000 companies through industry comfort estimates, and this trend is expected to accelerate. Looking back at past recessions and taking into account the unique characteristics of the current crisis, it is estimated that the total employment in the industry may fall by -8% (about 158,000 jobs), the number of companies may fall by -6% (about 13,000 companies), and-2009 respectively These are 13% and -7%.

Figure 3: The breakdown of the turnover of the 27 EU+UK textile and apparel industry by country/region, estimated value in 2019 (%)

Figure 4-Estimated industry turnover by market segment (2019, billion euros)

Stay away from fast fashion and encourage quality instead of quantity...

European fast fashion retailers such as Zara (Spain), H&M (Sweden), C&A (Netherlands) and Primark (UK) have played an important role in shaping fashion competition in the mass market. Relying on the combination of global supply chains, high turnover rates and low-priced goods, fast fashion has brought very tangible benefits to consumers, who have enjoyed a wider variety of products at lower prices in the past few decades. This has led consumers to increasingly prefer quantity over quality.(try suntech Loom)

From 2000 to 2015, the average clothing utilization rate (the average number of times a piece of clothing was worn) dropped by about 35%, while global sales doubled to more than 100 billion pieces per year. Fast fashion is increasingly prominent in the overall industry data.

Looking at T&'s retail volume A over time in specialty stores and population (Figure 5), we find that consumption in Europe has increased by more than 25%, with France (+31%) and the United Kingdom (+87%) since 2000 The growth was strongest since the beginning of the year. Adding online retail sales of clothing not included in the Eurostat data set will only make the trend more obvious (clothing has the highest online penetration rate of all product categories).

However, what is interesting is that the data shows that the "clothing peak" has begun to come true, and per capita consumption has stabilized in the past few years. The growth of the second-hand market cannot be accurately measured, but with the booming of classified advertising and peer-to-peer markets such as Vinted (Lithuania), it is easy to observe that this is another hint of a shift in the mentality of European consumers.

Figure 5-Per capita retail sales of textiles, clothing, and footwear accessories in specialty stores (2000=100).

Manufacturing labor costs are increasing

Due to relatively stricter labor regulations in Europe, higher labor costs, and a smaller labor force, European manufacturers cannot compete with foreign competitors when supplying large quantities of low-priced clothing to the vast majority of European clothing retailers. If per capita consumption returns to past levels and consumers trade quantity for quality, the situation may be different because labor costs are only a small part of the final retail price.

Some studies have attempted to assess the exact share of apparel manufacturing labor costs in the retail price of goods usually purchased in fast fashion stores in mature economies. A Deloitte study on the Australian market estimated that the average share of T-shirts was 4%, which is consistent with another study by the Swiss NGO Public Eye on Zara hoodies made in Turkey worth 25 euros. Keeping the tax rate and the percentage of wholesale and retail markups as a percentage of costs unchanged, a three-fold increase in labor costs will increase retail prices by 16.5%, and a five-fold increase will lead to a 32.7% increase in retail prices. In order for ordinary European consumers to keep their spending on clothing unchanged despite price increases, they need to reduce their purchases by 14% and 25%, respectively. In other words, they need to go back to the buying behavior of the 2000s.

Although more precise calculations need to take into account differences in labor productivity, lower freight rates and tariffs, we believe that the trade-off between quantity and quality has environmental and commercial significance. It also complies with the European Commission’s "Zero Waste Level", the highest priority of which is to prevent the generation of waste in the future.

Italy shows consumers' preference for quality supports local manufacturing

The preference for quality is actually one of the explanations for the flexibility of the Italian T&A industry. Despite increasing competition from manufacturers in Eastern Europe, North Africa, and Asia, since 1991, the country’s garment industry output has "only" decreased by -26%, while the industrial output of France and Germany has fallen by -97% and -89 %, Respectively. As seen in Figure 7 before, the per capita clothing consumption in Italy has remained flat for the past ten years, which is consistent with Figure 6, which compares the footprints of leading fast fashion retailers in the five largest markets in Europe- Italy lags far behind other large European retail markets. While growing, in a country where independent retailers with connections to local manufacturers still control a considerable market share, the penetration rate of large fast fashion retailers is much lower.

Unlike fast fashion retailers, Italy's largest clothing chains (Calzedonia, Miroglio Group, Max Mara) have manufacturing capabilities and rely on mixed factories in Italy, Eastern Europe and North Africa. Italy's preference for higher quality but more expensive clothing is also reflected in the expenditure of its households. More than 6% of its consumption is still used for clothing and footwear, which is a record high in Europe (Figure 7).

Eastern Europe and North Africa, and Italy's preference for higher quality but more expensive clothing are also reflected in their household expenditures. More than 6% of their consumption is still used for clothing and footwear, which is a record high in Europe (Figure 7). Eastern Europe and North Africa, and Italy's preference for higher quality but more expensive clothing are also reflected in their household expenditures. More than 6% of their consumption is still used for clothing and footwear, which is a record high in Europe (Figure 7).

Figure 6-The presence of top fast fashion retailers in Europe's largest market (store)

Figure 7 – The share of clothing and footwear in final household consumption (current price, %)

For a long time, NGOs and trade associations have been committed to meeting the needs of consumer behavior and aligning environmental goals with the interests of local manufacturers. Shaping the best needs, although a challenging and slow process, can usually be achieved in the following ways:

Raise consumers’ awareness of the environmental impact of fashion and insist on the importance of personal responsibility in achieving collective goals;

Improve buyer information and transparency, and help willing consumers switch to more sustainable consumption behaviors.

The sheer scale of European clothing imports will make any major shift from imported to locally manufactured goods a major driving force for the local clothing industry: a 10% reduction in clothing imports in Germany and France will be equivalent to an 8% increase in the turnover of the European clothing manufacturing industry.

NGOs and trade associations diverge on some supply-side incentives that will reduce the size of European manufacturers.

Whether a carbon tax can effectively reduce negative externalities (ie pollution) and give "greener" manufacturers an advantage over competitors has caused widespread debate. The textile supply chain can be said to be the most integrated of all industries. European manufacturers rely extensively on raw materials and semi-finished products imported from other parts of the world-the most direct impact of the possible carbon adjustment tax will be to increase the cost of European manufacturers, thereby Reduce their competitiveness. In the industry strategic roadmap outlined in June 2020, the industry trade association Euratex reiterated its support for an open and stable trading environment.

It can be seen that the key words of the future manufacturing and textile industries are low labor costs, quality preference, and environmental protection. Traditional manufacturing production models have gradually become difficult to adapt to the new manufacturing and textile production needs. The use of mechanized and intelligent production to replace manual production may be an indispensable method to improve production efficiency, save resources, and reduce link pollution.

In the entire textile process, the weaving link is very important, which directly determines the production and resource allocation of the entire textile industry. It is very necessary to reduce labor and reduce resource waste in this link.

Aiming at the problems of labor shortage, waste of resources, and low production efficiency, Suntech has developed and produced rapier looms with intelligent, automated, and digital applications based on 50 years of design experience and technology precipitation. The operation link is replaced by machinery. At the same time, the intelligent cloth inspection function is perfectly integrated, and the machine automatically inspects the finished cloth, which solves the most costly cloth inspection problem in the finishing process, and the cloth inspection effect is better than manual cloth inspection, the error rate is low, and the textile is realized. Process optimization and value maximization, reduce labor, greatly reduce labor costs, and improve production efficiency.

Customers who have used Suntech rapier looms are full of praise for this loom, which can be called artificial intelligence in the loom industry. According to statistics, this loom can save 50% of labor costs and 50% on average, and increase production by 50%. Efficiency, in addition to automatic cloth inspection, it can also be controlled by PLC, automatic weft seeking, servo electronic warp let-off, and servo electronic winding, which makes every step of the textile intelligent and greatly improves the production speed. Welcome to inquire.