European manufacturers are hit hard by unique trade, manufacturing and retail stalls

Since the outbreak of the Covid-19 epidemic, the European textile and apparel (T&A) manufacturing industry with a scale of 205 billion euros has not been able to escape the broader economic recession that has swept the world. So far, the pandemic has had a triple impact on the industry:

This impact is first reflected in trade activities, because China has entered a long and severe blockade period starting in February-the country is a major exporter of fibers and fabrics used by European manufacturers and a major destination for European apparel exporters. .

In turn, European production was hit by regional blockade measures, which started in the main manufacturing areas of Brescia and Bergamo (Lombardy). The manufacturing sector hit a new low in April, with a year-on-year decline between -35% (Germany) and -78% (Italy).

The region has also witnessed a collapse in demand, with its three client industries (export markets, local industries, and local clothing retailers) operating at low production capacity to avoid increased inventories and retain cash positions. The low point of the specialty retail industry also appeared in April, and the year-on-year decline fluctuated between -65% in the UK and -90% in Spain.

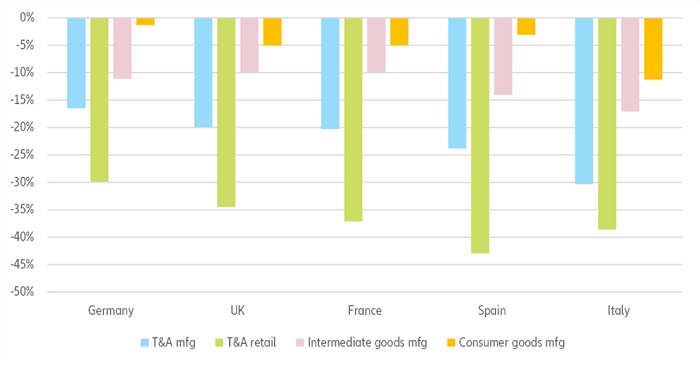

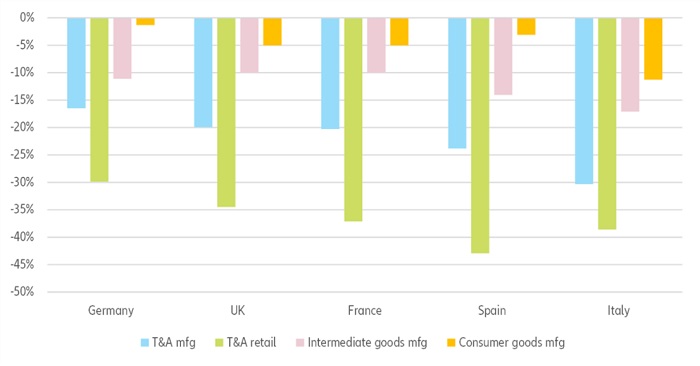

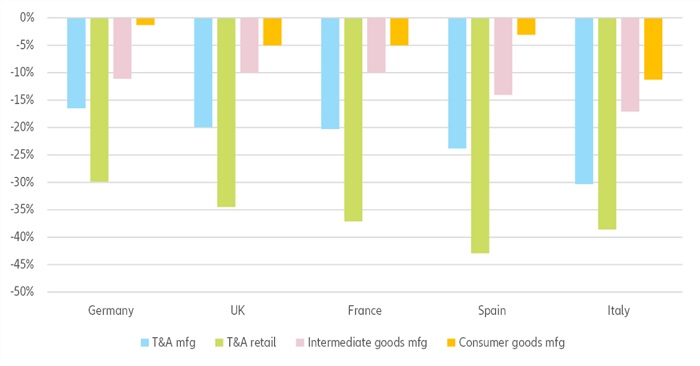

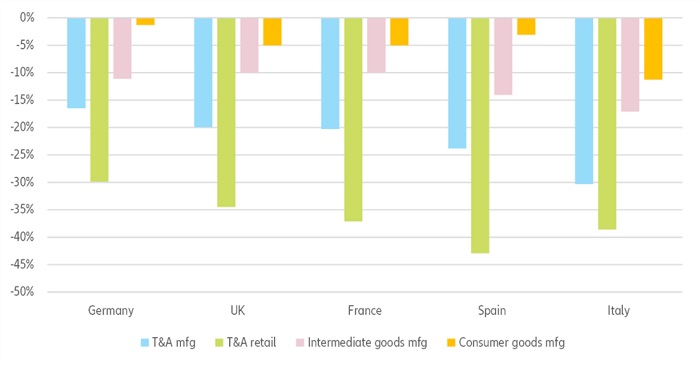

From the year-to-date manufacturing and retail activity data, there is strong evidence that the decline in transportation and consumer goods manufacturing and retail is much larger than other manufacturing activities. Since technical textiles are intermediate products, and consumer textiles are discretionary expenditures, the T&A industry is often hit harder during the economic downturn.

Figure 1: Year-to-date changes in T&A manufacturing turnover and retail sales of specialty stores and other manufacturing sectors (%)

Industry turnover will shrink by -19% in 2020

Combining the year-to-date industry turnover data with manufacturing purchasing managers' index, business confidence survey and economic scenarios in 2020, the European textile and apparel industry is expected to shrink by -19% in 2020 (Figure 2)

Italy, the largest manufacturer in the region, will experience a more significant decline (-22%) in 2020 due to poor performance in the first quarter and relatively high exposure to the apparel retail market. Since fashion is a seasonal business, the sales lost during the lock-in period will be difficult to compensate throughout the year, and inventory clearance will also put pressure on the realized prices. In addition, rising unemployment in Europe will affect consumer confidence and clothing purchases, which are typical discretionary spending items.

Due to the completely opposite reason, Germany will perform better, that is, the start of 2020 will be less dramatic and will have less impact on the fashion retail market. The turnover of German manufacturers should drop by -11% in 2020. The industry’s trade association textil+mode has been criticizing Germany’s stimulus plan on the grounds that the proposed value-added tax cuts are not enough to make up for the lost lock-in week and the proposed accelerated green agenda will threaten the cost competitiveness of German manufacturers.

France will be in an intermediate state and will be affected by -17% by 2020. Very similar to Italy, it has relatively greater exposure to the apparel retail market, but unlike Italy, its manufacturing base is narrow. It accounts for about a quarter of global luxury goods sales and is expected to suffer the collapse of this segment in 2020 (based on Bain & Company's median scenario of -22% to -25%).

In addition to a significant blow to turnover, we also expect the payment terms of troubled retail customers to deteriorate significantly. After large retail chains invoked force majeure clauses to freeze rents and cancel or delay manufacturers’ orders, the International Textile Manufacturers Federation (ITMF) called for understanding and cooperation between manufacturers and retailers.

Figure 2: Turnover of textile and apparel manufacturing industry (2008=100)

More resilient industries recover faster

Although revenue has been hit harder, the textile and apparel industry is expected to be more resilient than in 2009 and is more conducive to recovery. The combination of macroeconomic and industry-specific factors should enable the industry to rebound by +15% in 2021:

Unlike in 2009, the company’s financing conditions have not deteriorated so far. In fact, the central bank and the government are eager to provide sufficient liquidity for companies in trouble. The job retention plan also provides substantial relief for this labor-intensive industry: IVGT, one of the German trade associations, estimates that by June 2020, more than 80% of textile companies still have employees under part of the work plan.

In Italy, Italian manufacturers have accumulated more time for local partial unemployment programs in May 2020 alone than in the whole of 2019. This will avoid huge damage to the industry's total output potential in the short term.

European industry has also become more competitive. In 2009, European manufacturers were struggling to cope with the increase in the penetration rate of foreign goods, and Europe’s textile trade deficit doubled between 2001 and 2010 (2001 was the year China joined the World Trade Organization). This is no longer the case. Since 2015, the deficit has been basically flat. Secondary producing countries including the United Kingdom, the Netherlands, Denmark, Poland and Romania have seen significant growth in manufacturing in the past few years.

This reflects the transformation of the industry structure: the apparel sector accounted for 40% of the industry's total turnover in 2009, and now only accounts for less than 34%, but it has a more stable and competitive manufacturing base and focuses on high-end products. Since 2014, the market share of Italy and Germany in global trade has increased. The same is true for leather products and accessories: global trade in these products rose from US$43 billion in 2009 to US$88 billion in 2019. During this period, Italy's global market share rose from 10% to 14%, while France's rose from 28% to 32%.

From Eurostat’s apparent labor productivity data, we can also see the industry’s efforts to improve its product mix and increase productivity: between 2009 and 2017, the total value added per employee in the European industry increased by about 25%. The industry has increased by 30%. Textiles and 48% of leather products, footwear and accessories.

Nevertheless, the total European T&A turnover in 2021 will still be 7% lower than the 2019 level. Looking ahead to 2021, we expect growth to be more difficult to achieve and rely on strong assumptions about international tourist flow, etc. Although the country and the European Trade Association have reached out to key stakeholders to determine the recovery measures for specific industries, we believe that public policies can help reignite the growth of the industry and consolidate the positive trends that have been exerting in the past few years.

Accelerating the European Sustainable Development Agenda can accelerate recovery

From the production of plants and synthetic fibers to weaving and sewing to yarn dyeing, it is estimated that greenhouse gas emissions from textile manufacturing account for about 10% of global greenhouse gas emissions. Textile production is carbon-intensive in nature. Each metric ton of textile produces approximately 17 metric tons of carbon dioxide equivalent, compared with 1 metric ton for paper and 3.5 metric tons for fabric. By 2050, the trend of increasing per capita consumption may bring this proportion to more than 25%. In addition to greenhouse gas emissions, the industry is also a major consumer of water resources, with an estimated 73% of all textile production being incinerated or landfilled.(try suntech Loom)

Encourage the transition from linear manufacturing to circular manufacturing

The 2018 circular economy package adopted by the European Union has set new targets for the separate collection and treatment of textile waste-the per capita waste generation is about 19 kilograms, and clothing alone accounts for about two-thirds of the total. From an environmental point of view, the benefits of transitioning to circular manufacturing are obvious, and T&A is in the early stages of transition-the industry uses 97% of the original raw materials (plastic, cotton, linen, etc.) for production and 73% of waste Go to landfill or incinerator. In order to align environmental and commercial interests, European manufacturers need to partially replace their main resources with recycled materials. The world's largest apparel market and the second largest textile and apparel manufacturer, Europe not only has a huge reservoir to be tapped, but also has a competitive industry to capture opportunities for circular manufacturing. Stakeholders have nowhere to go and can only look at other departments that have established circular manufacturing to determine priorities:

On the supply side, taxation based on the "polluter pays" principle can be used to solve the financing problem of garbage collection, sorting and disposal-just like in some countries, electronic products, household appliances or furniture. This also stimulates production. Seek ways to reduce the impact on the environment. France is the only country in Europe that implements the so-called "Extension of Producer Responsibility" and has made significant progress.

Facts have proved that compared with more polluting alternatives, taxes are effective in encouraging reuse or recycling. By 2035, Europe’s goal is that only 10% of municipal waste will enter landfills, compared to 43.6% in 2006 and 23.5% in 2017.

Additional public support will also be most welcome to accelerate research and development projects focused on improving textile waste collection, treatment, reuse, and recycling-the technology is far less mature than the glass or paper industry. The technical barriers to more recycled materials are still very important, and the service life of textile fibers is not unlimited.

Demand must also be supported to create a real market for recycled materials and consumer products containing recycled materials, usually through the goal of distributing recycled materials among viable products. In other sectors, public procurement can help stimulate demand and encourage private sector adoption.

France formulated the EPR plan in 2007 to improve textile waste management. A Producer Responsibility Organization (PRO), Eco TLC, aims to improve the collection, sorting and recycling of textile waste, thanks to the funds paid by the producers and calculations based on their estimated waste generation. Eco TLC signs contracts with private companies to invest in collection facilities, sorting infrastructure, research and development programs, etc., to achieve the goals set by public authorities. The polluter pays program incentivizes manufacturers to reduce waste generation, while at the same time incentivizing PRO to find the most effective solution to achieve its goals. The tonnage of textile waste collected in France has jumped from 17% of the total textile sales in 2007 to about 40% in 2018, 40% of which is reused, recycled or converted into fuel.

It can be seen that only low labor costs, environmentally friendly, sustainable manufacturing and textile production companies can adapt to future industry development needs, adapt to changes in the global environment, and improve risk resistance. How can the development direction be more suitable to adapt to the changes in the future situation? Perhaps it is a good way to replace manual production with mechanized and intelligent equipment.

Help manufacturers seize the opportunities of new technologies

The digital revolution in the T&A industry has not yet arrived. In a groundbreaking research paper on the risk potential of job automation, researchers Carl Benedict Frey and Michael Osborne found that by 2023, typical jobs in the apparel industry are particularly likely to be computerized, with 83% tailoring and sewer Is 99%. However, because the technology lags behind expectations, and because it does not guarantee return on investment, clothing manufacturing has not changed much in the past few years and still relies on labor. Adidas gave up the case of using 3D printing technology to manufacture sports shoes in Germany and the United States, and more specifically clarified the challenges faced by the industry's big names in achieving profitable automated production.

Figure 3-Cumulative sales of industrial robots in the textile, clothing and footwear industries (units)

However, this does not mean that the productivity of the apparel manufacturing industry will never increase. Despite facing economic and technical challenges, real progress has been made. The combination of labor and collaborative robots is seen as having strong potential. One of the reasons for the relatively slow adoption of new technologies in the industry is its fragmented structure. Small and medium-sized enterprises account for 60-70% of the European industry’s turnover, which is twice the average level of the entire manufacturing industry.

Figure 4-The proportion of SMEs in industry turnover (%)

Since the increase in automation will help reduce the relatively high cost structure in Europe, support funds to support industry SMEs to invest in more advanced manufacturing processes can increase the competitiveness of European manufacturers—and stimulate both Germany and Italy. The world’s second and third robot industries are the largest robot manufacturers.

In addition to automation, apparel manufacturers should also accelerate the development of e-commerce capabilities. Although e-commerce is not enough to make up for the closure of stores, at the height of the Covid-19 crisis, online sales were booming, and large retailers did get some relief: online sales of Gap, H&M and Inditex increased in the first quarter 10% and 48% and 50%, respectively. For high-end and luxury goods manufacturers, the motivation to reconnect with their international customers is particularly high when travel restrictions continue.

It can be seen that the intelligent development of manufacturing and textile industries, replacing manual production with mechanized and intelligent equipment is the only way for the future industry. Aiming at the problem of high labor dependence and high labor cost, Suntech has developed and produced rapier looms with intelligent, automated, and digital applications with 50 years of design experience and technology precipitation. Links are replaced by machinery.

Suntech rapier looms can perform automatic machine inspection on the finished cloth, and solve the most difficult textile problem of most textile enterprises-cloth inspection. Enterprises do not need to hire additional inspectors with high wages and high technical requirements, which saves expensive inspection costs, and the inspection effect is better than manual inspection, with a low error rate, which optimizes the textile process and maximizes value, and reduces Labor, greatly reducing labor costs and improving production efficiency.

Customers who have used Suntech rapier looms are full of praise for this loom, which can be called artificial intelligence in the loom industry. According to statistics, this loom can save 50% of labor costs and 50% on average, and increase production by 50%. Efficiency, in addition to automatic cloth inspection, it can also be controlled by PLC, automatic weft seeking, servo electronic warp let-off, and servo electronic winding, which makes every step of the textile intelligent and greatly improves the production speed. Welcome to inquire.