As the fashion industry strides into 2024, it faces a landscape marked by persistent challenges and uncertainties. The year 2023 witnessed slower growth in Europe and the US, coupled with a fading performance in China's once robust market. Even the luxury segment, which initially fared well, succumbed to weak demand, resulting in declining sales and uneven performance.

In this era of uncertainty, the key players in the fashion industry are gearing up for transformative changes in the coming year. Amidst concerns of subdued economic growth, persistent inflation, and weakened consumer confidence, businesses are challenged to identify pockets of value and unearth new drivers of performance.

McKinsey's Fashion Forecast anticipates global industry growth of 2 to 4 percent in 2024, with variations at regional and country levels. The luxury segment, despite being a significant contributor to economic gains, is expected to face challenges in the tough economic environment. Growth is forecasted at 3 to 5 percent globally, down from the 5 to 7 percent in 2023, as consumers tighten their spending post-pandemic surge. European and Chinese markets are set to slow down, while the US anticipates a rebound after a relatively weak 2023.

Beyond the luxury realm, the forecast suggests a growth of 2 to 4 percent, aligning with the possible outcomes of 2023. Europe's market is expected to expand by 1 to 3 percent, with declining consumer confidence and household savings being attributed to restrained spending. In the US, the luxury sector is forecasted to grow by 0 to 2 percent, and China is projected to face challenges with a growth rate of 4 to 6 percent, a slight increase from the end of 2023 but slow on a historical basis.

While uncertainties prevail, there are geographical outliers offering comfort. India, for instance, boasts consumer confidence reaching a four-year high in September 2023. Executives in India express more optimism than their Western counterparts, with 85 percent reporting improvement over the past six months, according to McKinsey's Global Economics Intelligence survey. In China, despite economic challenges, consumers exhibit a higher intent to shop for fashion in 2024 compared to the US and Europe.

To navigate the challenges and seize opportunities, leading fashion companies are prioritizing contingency planning for the year ahead. A central theme involves maintaining a tight grip on costs and inventory while fostering growth through precise price management.

In this dynamic environment, brands and suppliers can anticipate heightened competition but also uncover opportunities to introduce new styles, tastes, and preferences, ultimately contributing to value creation. To thrive, fashion brands should consistently review and optimize their operations for maximum effectiveness, considering both profitability and sustainability perspectives.

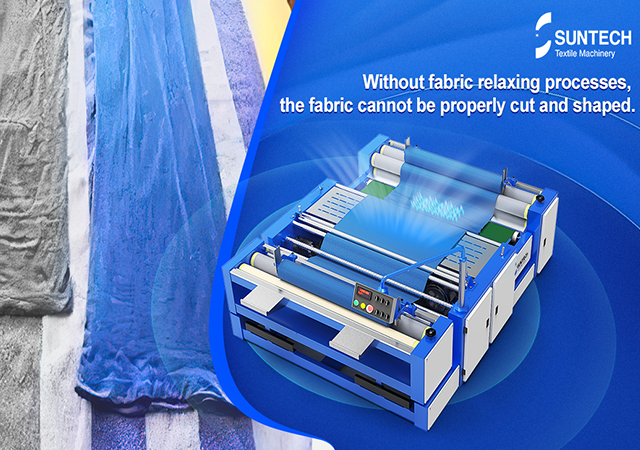

Amid these transformations, SUNTECH Textile Machinery emerges as a vital ally for the fashion industry. With its cutting-edge technology and innovative solutions, SUNTECH offers support in enhancing operational efficiency, cost management, and sustainability, aligning with the evolving needs of the fashion landscape. As the industry navigates uncertainties, SUNTECH stands ready to empower fashion businesses with the tools they need to adapt, thrive, and unlock new possibilities in 2024 and beyond.

SUNTECH also provides a variety of textile machinery and material handling equipment that involves AI technology, such as fabric relaxing machine, motorized beam trolley, and the automatic packaging machine.