Key highlights from the Tradeshift Global Trade Index:

China turnaround: Trade activity in China rose at the most significant rate in Q1. Transaction volumes grew at two points above the expected level, the highest in more than two and a half years.

US momentum: The US also continued gaining momentum in Q1, with total trade activity tracking one point above the baseline. Order volumes surged to seven points above the expected level, following growth of a similar level in the previous quarter.

Manufacturing recovery: Tradeshift sees growth coming in part from an uptick in demand across the manufacturing sector where trade activity tipped back into the expected range for the first time in a year.

Eurozone edges higher: Activity levels across the Eurozone improved to three points below the baseline in Q1 having sunk as low as nine points below that level just six months earlier. New orders grew at six points above anticipated levels.

UK orders disappoint: UK trade activity improved to four points below the expected level in Q1, but order volumes were sluggish, tracking five points below expectations.

Despite the positive signs of recovery in orders, challenges remain for suppliers, particularly in terms of liquidity and to those looking to ramp up supply chain activity. Although invoice payment times have decreased since their peak in Q3 2022, suppliers still face a 6% longer wait compared to the pre-pandemic era.

The forecast for trade growth faces risks primarily from geopolitical tensions and policy uncertainties," the WTO report said

Factors of the Export Growth

Resilient global demand: Despite global economic uncertainties, demand for Chinese apparel and textiles remains strong in international markets.

Shifting consumer preferences: A growing focus on value and affordability might be driving consumers towards Chinese-made garments.

Government support: The Chinese government's efforts to stimulate domestic consumption through initiatives like tax breaks and infrastructure spending could be contributing to the positive trend within the domestic market.

However, the positive performance in the apparel and textile sector stands in contrast to the broader Chinese economy, which is grappling with a sluggish consumer market and a slumping real estate sector. Analysts believe the government will need to implement additional measures to stimulate domestic spending and stabilize the property market to achieve its ambitious annual growth target of around 5 percent.

The future path of China's apparel and textile industry hinges on several factors, including global trade dynamics, geopolitical tensions, and the effectiveness of government stimulus policies. Continued strong export performance can fuel further growth, but external factors like trade barriers pose potential risks. The industry's ability to navigate these challenges will be crucial in determining its long-term success.

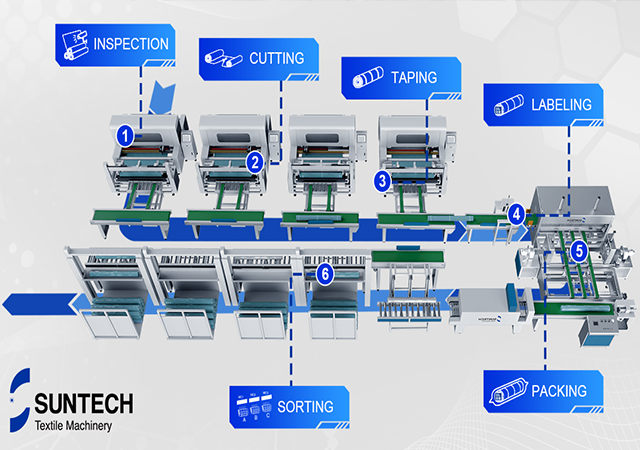

SUNTECH Textile Machinery is a leading expert in the field of automation and intelligent manufacturing, providing advanced solutions for the global textile industry. With a range of textile machinery, SUNTECH aims to achieve a smart factory that eliminates the need for manual work, help textile manufacturers streamline production processes, improve efficiency and reduce costs.