The textiles and apparel sector can create jobs and spur further industrialization in countries recovering from COVID-19.

To make the most of this opportunity, however, countries will need to embrace new partnerships and approaches.

The COVID-19 pandemic is an unprecedented public health crisis that has exerted an external shock on the global economy. Despite this contraction, the textile and apparel industry could be a key engine for growth and employment in certain countries.

The textile and apparel opportunity

Countries building back after COVID-19 should not ignore the textile and apparel industry; it is considered a starter sector in the road to industrialization. When the industry expands, it provides a base on which to build capital for more technologically demanding industries. In fact, the textiles and apparel sector can be critical to the growth and development strategies of many developing countries.

The global textiles and apparel industry market had a retail market value of $1.9 trillion in 2019 and is projected by Boston Consulting Group to reach $3.3 trillion in 2030, growing at a compound annual growth rate of 3.5%. Projections ahead of COVID-19 forecasted that population growth, rising levels of disposable income and rapid urbanization in developing countries would likely drive demand in the future.

Textile and apparel exports constitute an important share of the total exports in a range of countries: 85% in Bangladesh, 59% in Pakistan, 12% in Turkey, and 11% in Egypt. Still, while many countries are well-positioned in the raw materials or the production stage of the textile and apparel global value chain (GVC), they are only playing a limited role in the absence of retail (comprised of marketing, branding and sales). Thus, they have potential waiting to be unlocked to reap more benefits from the global markets.

Additionally, the textile industry creates a special opportunity during the pandemic given the number of employment opportunities it can provide. This labour-intensive sector employs millions, and the share of employment in the sector across the total manufacturing workforce is significant in Islamic Development Bank (IsDB) member countries.

IsDB’s 57 member countries would especially benefit as these countries jointly represent the purchasing power of almost one quarter of the world’s population. With GDP growth rates of up to 8% per year, their economies have considerable potential to further increase their market share in the global economy.

Strategic investments

Those investing in the textile and apparel market could yield tangible economic benefits from targeted investments. Sustainable and recycled fibres represent one such opportunity, as they are poised to replace resource-intensive raw materials at an increasing pace. Additionally, technical, smart textiles have enormous potential to be used in several industries such as automotive, construction and medical equipment.

Emerging tech, already transformative, will continue to shape the textile and apparel sector. Data applications, artificial intelligence (AI) and machine learning, and 3D printing are some of the technologies enhancing product design processes and reducing lead times, leading to laser-cutting machines, sewing robots, and nanotechnology. Furthermore, COVID-19 has shown the need for blockchain technology to create transparency and traceability throughout the supply chain, providing other opportunities within the market.

COVID-19 could also fuel a shift to nearshoring, ensuring factories are closer to their final sales markets. Additionally, leading firms will seek strategic partnerships with first-tier suppliers to meet demand and reduce lead times. The future market structure will mainly be determined by a country’s location, as well as the ability of its textiles and apparel industry to provide cost-effective production, competitive skills, quality products and efficient lead times.

Looking ahead

Countries must act swiftly and strategically to restart and restructure their economies. Not doing so could widen existing gaps in wealth, technology, and productivity gaps across borders.

Making these shifts will take a series of tactical changes, including strengthening and broadening processing capabilities, bridging the infrastructure gap, developing sustainable textiles and apparel production capabilities, and strengthening the external image of the country as a destination of choice for the textiles and apparel industry.

Such changes will also take new collaborations between a range of different actors. For textiles and apparel, collaboration with industry associations (within and across countries), as well as joint projects with universities, can strengthen knowledge exchange and drive innovation. Partnerships with brands and knitting houses or weaving mills can also foster more vertical integration for companies. These collaborations can unlock higher added-value within countries and provide a strong return on investment.

To this end, the IsDB has set clear goals to catalyze private and public investment for its 57 member countries to fuel their economic and social development and drive the competitiveness of key industries linked to the global market. For instance, the IsDB is building a platform for its member countries to bring together a range of stakeholders to drive key changes, including: increased trade and investment relations; co-financing arrangements with the public and private sectors; multilateral development banks and other international organizations; and boosted private-sector engagement in development interventions.

Overcoming the hurdles brought by the pandemic - and recovering quickly – will not be easy. It will take new collaborations and new approaches that add value to economies. Still, countries and firms that can adapt to new shifts and new relationships will reap the most benefits in the medium and long term – and be the most resilient ahead of the next big crisis.

How to promote the development of textile industry

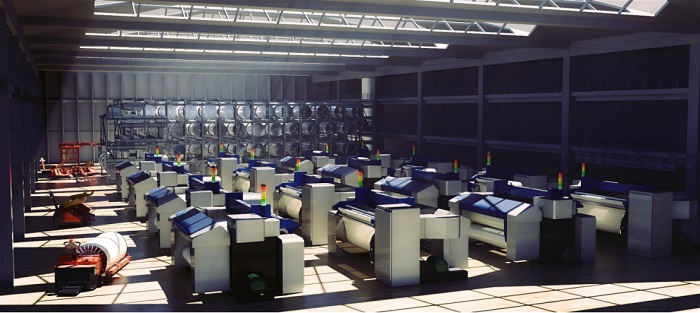

At present, the key to promoting the development of the textile industry is to improve the efficiency and quality of textile production. First, the mechanization, automation, and intelligence of equipment should be improved to replace traditional manual production, reduce production error rates, and improve production efficiency. At the same time, with the development of society, labor costs are getting higher and higher, reducing dependence on manual production can reduce labor costs.

With 50 years of design experience and technology accumulation, Suntech has developed and produced rapier looms with intelligent, automated, and digital applications to integrate various textile processes, optimize production procedures, and improve production efficiency. As we all know, in textile production, the most labor-intensive process is not the production process, but the finishing process, including cloth inspection and packaging. Among them, the cloth inspection process requires high skill, vision, and experience of workers, and the wages are high, and the manual cloth inspection efficiency is low and the error rate is high.

Suntech rapier looms can perform automatic machine inspection on the finished fabrics, eliminating the high cost of inspection, and the inspection effect is better than manual inspection, realizing the optimization of the textile process and the maximization of value, reducing labor and greatly Reduce labor costs and improve production efficiency.

Customers who have used Suntech rapier looms are full of praise for this loom, which can be called artificial intelligence in the loom industry. According to statistics, this loom can save 50% of labor costs and 50% on average, and increase production by 50%. Efficiency, in addition to automatic fabric inspection, it can also be controlled by PLC, automatic weft seeking, servo electronic warp let-off, servo electronic take-up, so that every step of the textile is intelligent, and the production speed is greatly improved. Welcome to inquire.